Insurance Marketing

It’s much harder to market for insurance, like life and disability insurance, through traditional ways. Your potential customers search for your services on search engines using insurance-related keywords. Whether you are a commercial insurance company, a self-employed agent selling commercial insurance in your local area, or a certified agent for a national firm, we have a solution for you. With one of the best affordable insurance marketing agencies, you get-

- Increased online brand awareness & more insurance leads.

- Competitive advantage by feature in Local 3 pack.

- Lower CAC (cost per lead acquisition).

- Increased insurance premium revenue.

Invest in Digital Guider’s customizable marketing services to cover your business with the risk of online damage.

Today’s market is all about online searches. People are looking for the best insurance policies online, so if your website isn’t in the top searches, your competition is. That’s where targeted insurance marketing strategies can help get your website to the top and get your business seen by potential customers. Your insurance companies need a one-of-a-kind marketing strategy. Being part of the Your Money, Your Life (YMYL) industry, it should be your top priority to deliver value, transparency, and relevance to your clients to earn their trust and loyalty and create E-E-A-T content.

Let’s see how marketing for insurance can get you more insurance leads.

What Is Insurance Marketing?

Insurance marketing refers to targeting the right consumers & advertising/promoting your insurance services to sell more policies and increase profits. Insurance advertising involves marketing techniques, such as networking, nurturing, and promoting through several channels.

As most people are searching for insurance companies online, it is important to focus on marketing your insurance services on digital channels, in which online marketing for insurance agencies will be your best bet.

In this guide, we will learn all about the digital strategies you can use to advertise & promote your insurance offerings.

What is the Purpose of Insurance Marketing?

| Reputed Online Reputation | Sell More Insurance |

|---|---|

| When people see your website at the top of search results, it gives them a sense of confidence and trust. A good online reputation will help you stand out and attract more customers. | When your website appears higher on search engine results for the right insurance keywords, you get targeted organic traffic and are better equipped to sell more insurance policies. |

| Be Industry Leader | Higher Quality Leads |

| The more visitors to your site, the more chances you have to promote your insurance products and position your brand as a leader in the industry. | As you market your services online, you attract visitors who are already interested in insurance products; therefore, you have a higher chance of attracting long-term, valuable customers. |

What Is The Best Way To Market An Insurance Company?

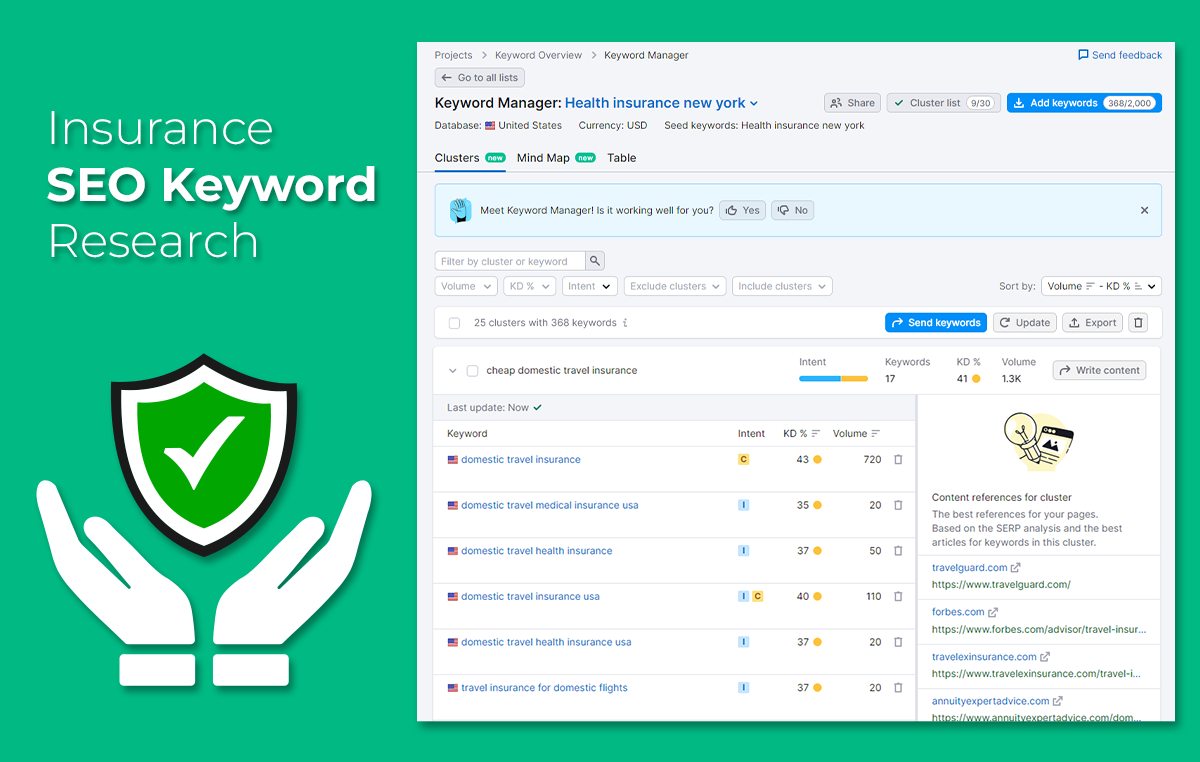

1. Insurance SEO & Keyword Research

Insurance SEO is the process of optimizing insurance websites for search engines. It includes strategies and techniques to improve insurance website rankings and online visibility. SEO is a great way of inbound insurance marketing strategy to generate leads online and stay ahead of competitors. It aims to drive organic traffic to your insurance website, increasing online visibility and attracting potential customers.

When someone searches for an insurance-related keyword like “ insurance agencies near me,” your brand’s URL must be at the top of the search results. Your goal should be to rank among the top five search engine results. Start by creating a list of insurance-related terms, and use tools like Google Keyword Planner, SEMrush, or Moz Keyword Explorer to make your list bigger.

Look for keywords that have a good mix of search activity and competition. You might also want to think about long-tail words with more specific meanings and higher intent, like ‘affordable auto for young drivers’ or ‘term life quotes for seniors.’

2. On-page SEO Optimization

On-page SEO helps you rank higher in search results, get more people to visit your website, and get more conversions. It takes time to see the results, but on-page SEO can boost your online rankings and sales once you start.

On-page elements are essential for search engines to understand your insurance website’s relevance and quality. Some helpful on-page optimization tips:

- Include relevant keywords in page titles and ensure they’re short and sweet.

- Write captivating meta descriptions summarizing your content and making users want to click.

- Utilize header tags to organize your content and naturally include target keywords.

- Make sure your URLs are SEO-friendly, descriptive, and contain relevant keywords.

- Use internal linking to make your website easier to navigate and assist search engines in understanding your content structure.

These on-page improvements for insurance SEO will improve your website’s visibility and help you rank higher in search results.

3. Navigational & Responsive Website Structure

Your website’s UX depends on the responsive design’s impact. Ensure the site structure is clear and flows well before writing the website’s content. It won’t matter how much excellent content you have if it’s difficult to navigate: Your visitors and potential clients will become irritated and perhaps turn to your competitors.

Page load time is an essential factor in ranking your website higher and the UX of your prospective customers. Google prioritizes sites with faster page load speeds if it improves the user experience. It is also important that your website is responsive so it is accessible on all devices and helps your online insurance advertising efforts. Digital Guider’s web development team can help you optimize your website speed and UX for users and Google’s crawlers.

Must read: What Is Google Lighthouse – How Does Its Score Affect SEO?

4. Content Optimization

Creating high-quality content is key to making your insurance website appear higher and more often on search engine results pages (SERPs). When you have good content, people are likelier to link to and share it on their social media accounts, which helps your overall marketing efforts. To increase your content reach, your content should be relevant, informative, and optimized for the search engines so they can easily index it. You can use many content marketing strategies like,

- Create comprehensive, well-researched, and original content.

- Develop a content strategy that covers various insurance topics, including guides, tutorials, FAQs, case studies, and industry news.

- Incorporate target keywords naturally within your content, including headings, subheadings, and body text.

- Include visually appealing images, infographics, and videos to enhance user experience and engagement.

- Regularly update and refresh your content to keep it relevant and up-to-date.

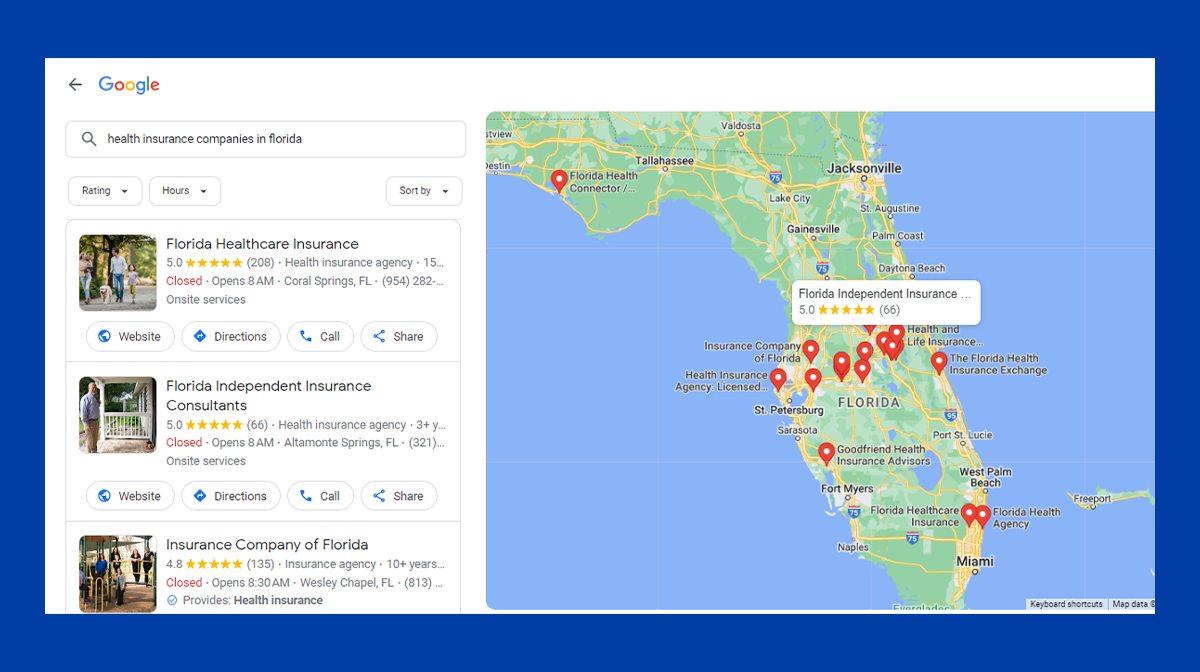

5. Local SEO Marketing For Insurance Agents

As more and more customers search for insurance online, ensuring your business is visible online is essential. Optimize your Google My Business listing and prioritize local Google searches. Highlight your business’s photographs, client reviews, and any recent blog content published on your website.

In addition to optimizing your GMB listing, optimizing your website for local searches is also important. Incorporate localized keywords throughout your website. For example, instead of optimizing a single keyword phrase such as “life insurance” to capture local interest, include the city and region in the keyword, like“ best health insurance companies in (your city)” or “ cheap car insurance near me. “

6. Collect Reviews

Encourage customers to provide honest reviews on your insurance website, Yelp, Google My Business, and other review websites. This is one of the most favorable methods insurance marketing agencies use to advertise the agency’s offerings.

A wonderful technique for convincing and inspiring clients to want to leave you a favorable review is by providing a modest reward or a future service discount. Prospective clients frequently look to reviews from past clients to decide whether to pick a specific insurance agent. Potential new clients will trust you more as you gain more local reviews.

Good customer reviews make wonderful marketing tools! Because potential customers can see how you interact with your brand, testimonials are also helpful for making your business more trustable. It is more likely that your website or Google My Business page will be promoted to the top of the search results the more engagement you receive. Digital Guider’s online reputation management services will help you get reviews, collect client feedback, and protect your online reputation.

7. Link building for Insurance Brokers

By acquiring backlinks, you can increase your website’s domain authority while working on off-page SEO. These backlinks tell search engines that your website is credible and relevant when it appears with a link on another well-known, high-traffic website. The number of methods that individuals can find your agency’s services is increased by this tactic as well. The latter results in more traffic, which is another algorithmic relevance indicator.

You can also use regional company directories/ websites like-

|

|

|---|

You can contact these sites, offer guest posts, or write articles for them. Or, you could do some outreach to get links from other websites that are related to yours.

Sell More Policies With Insurance Marketing Agency!

A trusted reputation is the crux of a successful insurance company. Your business will be more known if you build good client relationships. However, getting individuals into your office can occasionally be the most difficult part of growing your business.

If you’re an insurance broker, agent, or company, you definitely need insurance marketing services to enhance your overall online reputation. Digital Guider is here to help you get the most out of your marketing strategy. As a reputed Insurance marketing company, we’ll work with you to create custom solutions to help your website get more traffic, rank higher in search engines, and show off your brand. Plus, our content marketing team will ensure your content is relatable to the insurance industry audience, and our customer service team will be there for you at every step.

Call us now at – +1-307-209-3608 or book a free consultation call to get started with your growth journey!

Insurance SEO Services- FAQs

How does SEO work for insurance companies?

SEO for insurance companies involves various strategies such as optimizing website content, conducting keyword research, building quality backlinks, improving website speed, and ensuring mobile-friendliness. These techniques help search engines understand and rank insurance websites better. For more details, kindly connect with our experts at 1-307-209-3608.

Can SEO help my insurance company appear higher in search engine results?

SEO can help your insurance company rank higher in search engine results. By implementing effective SEO techniques, You will increase the chances of your website appearing on the search engine results page by increasing its visibility.

How long does it take to see results from SEO efforts?

SEO is a long-term strategy that usually takes time to see significant results. The timeline can vary based on factors like the insurance industry's competitiveness, your website's current state, and your SEO efforts' effectiveness. On average, it can take several months to a year to see noticeable improvements. Setting realistic expectations and understanding that SEO is a gradual journey is essential.

What are keywords, and how do they impact insurance SEO?

Keywords are words or phrases people use to search for insurance-related information online. In insurance SEO, identifying and using relevant keywords enables them to match your content with user queries more effectively.

Should insurance companies focus on local SEO?

Absolutely! Local SEO is crucial for insurance companies targeting specific geographic areas. By enhancing your website for regional search terms, developing regional business listings, and getting positive reviews, you can improve your presence in your local area and attract local customers.

Are backlinks important for insurance SEO?

Yes, backlinks are essential for insurance Links pointing to your website from other websites is known as SEO backlinks. They act as a signal of credibility and authority, showing search engines that your website is reputable. Building high-quality backlinks can improve your website's authority and search engine rankings. For more details, you can book a free consultation with our experts.

How can content marketing benefit insurance SEO?

Content marketing plays a significant role in insurance SEO. Your intended audience can be drawn in and entertained. by creating high-quality and informative content such as blog posts, articles, and guides. This can increase website traffic, social shares, and backlinks, positively impacting your SEO efforts.

Is it necessary to hire a professional SEO service for my insurance business?

While learning and implementing SEO techniques yourself is possible, hiring a professional SEO service can offer several advantages. They have the expertise, resources, and experience to devise and execute an effective SEO strategy tailored to your insurance business, saving you time and effort.

How can I measure the success of my insurance SEO efforts?

You can measure the success of your insurance by monitoring essential parameters such as organic search traffic, keyword rankings, conversion rates, and website engagement. Tools like Google Analytics can provide valuable insights into your SEO performance, allowing you to make data-driven decisions to optimize your strategy.