Remember the last time you needed insurance? 🤔

Chances are, you turned to Google to find the best options nearby, read a few reviews, compared different plans, and maybe even filled out a form.

That’s exactly how today’s consumers buy insurance policies. If your agency doesn’t show up in those critical search moments, you are losing business to competitors who do.

This is where Insurance SEO becomes essential—to show up when people are online looking for the insurance coverage you offer. 🧑🏼💻

In this blog, we will break down how effective SEO strategies can boost your rankings, drive more qualified leads, and deliver a better ROI for your insurance business.

What Is Insurance SEO?

SEO for insurance companies and agents is a specialized strategy designed to boost the online visibility and search ranking of an insurance agency or brokerage. Whether it’s for vehicle, health, life, or any type of insurance, SEO helps your business appear in front of potential customers right when they need your services the most.

🤔 Think of it this way: You own an insurance agency with amazing plans, top-notch services, and a friendly team, but it is buried down a street no one ever visits. That’s what it’s like when your website doesn’t show up on Google. 😬

That’s where Insurance SEO makes a difference — making your business easy to find, trusted, and visible on the internet.

Grab Your Free Insurance SEO Checklist 📝 Boost your insurance agency’s online rankings and attract more clients. Get our easy-to-follow, ready-to-use SEO checklist now! |

So, why is SEO for insurance agencies now more than ever? Let’s break it down.

Why SEO Is Crucial for Insurance Agencies?

Whether you offer auto, health, life, or home insurance, one thing’s certain—no one flips through phone books anymore. 📖

Back in the day, people relied on referrals or walked into the nearest office.

But today, it’s all digital—your potential customers are turning to Google, searching for terms like “trusted insurance broker near me” or “affordable life insurance policies.” That’s where SEO becomes crucial for insurance businesses.

👇Here’s why investing in SEO pays off:

Reach Ready-to-Buy Customers

In the insurance industry, people searching for “home insurance quotes” are often ready to make a decision.

Here, your business needs SEO to reach these visitors who are actually looking for the insurance products you offer. This means more quality leads, not just random clicks.

Build Trust and Credibility

Did you know? The first result on Google gets about 27.6% of all clicks. 👆🏼

This shows that people tend to trust businesses that appear at the top of search results. It makes your insurance agency look more authoritative and professional.

Stay Ahead of Competitors

If you’re on page 1 and your competitor is on page 5, who do you think gets the business? 🤔

Of course, your business will get more clicks and leads. 📈

SEO for insurance companies helps you stay ahead of your competitors and capture more of the online market.

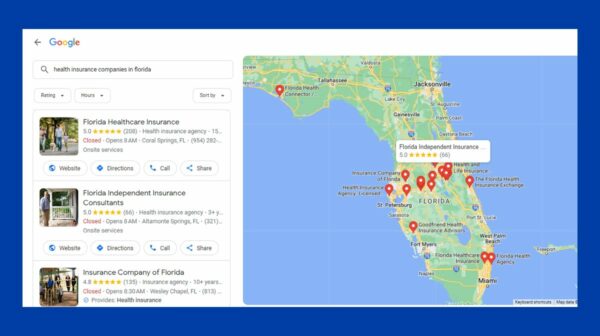

Boost Local Visibility

For many insurance agencies, a significant portion of their business comes from their local area.

That’s why insurance local SEO is the key to connecting with potential customers—by targeting “near me” searches, using location-based keywords, and optimizing your Google Business Profile.

Maximize Marketing ROI

Your insurance agency might be running pay-per-click ads to reach a wider audience, but once you stop paying, the traffic disappears.

On the other hand, SEO for insurance agencies delivers long-term, cost-effective results by continuously driving organic traffic to your website.

Now, before you start thinking of SEO as a magic fix, here’s the reality:

⚠️ SEO for insurance companies and agents comes with its own challenges—and understanding them is the first step to beating the competition.

Key SEO Challenges for the Insurance Industry

Highly Competitive Market

Ever noticed how the giants of the insurance industry spend massive budgets on marketing? 💸

It’s no surprise they dominate search engine results.

This is why small local agencies often struggle to stand out in such a fiercely competitive space. Without a focused insurance SEO strategy, climbing the rankings and getting noticed online feels like a tough challenge.

Strict Advertising & Content Guidelines

Whether you own a well-known insurance agency or work as a local broker, you have to follow strict guidelines by regulatory bodies for promoting insurance products.

This means your content (like policy breakdowns, how-to guides, and insurance tips) must be trustworthy, well-sourced, and compliant—making quality SEO not just important, but essential. 📝

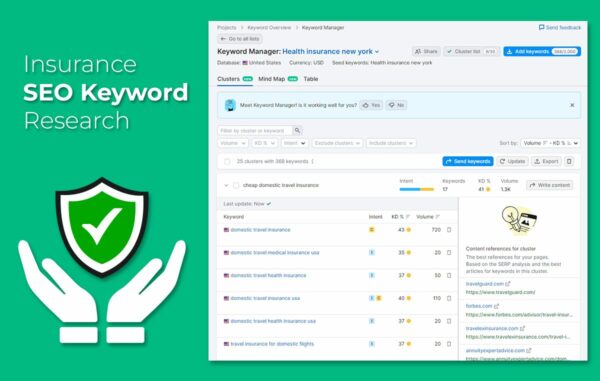

Complex Keyword Targeting

Everyone’s searching for popular terms like “car insurance” or “life insurance agent.” To compete against these broad keywords and outperform the top insurance agencies can be a struggle for smaller firms.

It takes smart keyword research & strategic planning to strike the right balance between high-volume broad terms and targeted long-tail keywords that actually convert.

Multiple Insurance Line Complexities

Insurance agencies juggle many policy types—auto, home, life, health, and more—each with its own features and audience.

Here, the real challenge is creating unique, clear pages for each without repeating content. When information gets complicated or confusing, potential customers can easily get lost—and that means missed opportunities.

Building Credibility

In the insurance industry, trust isn’t just important—it’s everything. But for small agencies, standing out and proving credibility is tough because customers demand clear, honest information and real proof you can deliver.

Balancing insurance marketing efforts to build genuine trust—while also competing with large companies—you’ve got to earn their confidence in a sea of competitors.

While these challenges in insurance SEO are real, the good news is—they’re fixable. ☑️

With the right SEO strategies for insurance agents, you can boost visibility, build trust, and drive more leads for your business.

Proven SEO Strategies to Grow Your Insurance Business

Even if you have a website for your insurance business, you might still wonder why you struggle to reach customers who are searching for exactly what you offer? 🤔

The key is using effective SEO strategies for insurance agents that connect you directly with those potential clients.

✅ Optimize for Local Search

Targeting your local audience is one of the most important parts of insurance marketing, where you can boost your foot traffic to the agency or inquiries from local customers.

👇🏼 Here are some tips to drive calls and leads from your local SEO for insurance agents:

- Use location-based keywords such as “life insurance in Dallas” or “affordable auto insurance near me”

- Create and optimize your Google Business Profile

- Get listed in local directories and citations

- Collect reviews and feedback from local clients

Interesting Read: 15 Ways to Optimize Your Google Business Profile (GBP) to Rank Locally

✅ Target Buyer-Intent Keywords

Understand what potential clients are searching for. The terms may be broad, like “car insurance,” or more specific, such as “affordable car insurance in Austin” or “term life insurance rates for seniors.” For targeted keyword research, use tools like Google Keyword Planner or Semrush.

Moreover, address the pain points and specific needs of your customers in the content to build a strong connection.

✅ Create High-Quality, Helpful Content

To drive traffic to your website, your content should be informative as well as engaging so that visitors not only find the information they need but also feel encouraged to explore more, build trust, and take action. 📝

- Write blogs, FAQs, and guides (e.g., “How to choose the right health insurance”)

- Answer common customer questions and inquiries

- Use simple and easy-to-understand language to build trust

✅ Optimize Your Website for SEO

Your website might look great and have strong CTAs, but if it’s not SEO-friendly, search engines like Google won’t prioritize it — and your potential customers won’t find you.

👇🏼 Here are some SEO tips to optimize your insurance business’s website:

- Use proper title tags, meta descriptions, and header tags

- Improve page speed and mobile responsiveness

- Ensure a clean, user-friendly site structure for easy navigation

Interesting Read: SEO Checklist: 50+ Best Practices for Complete Website Optimization

✅ Build Quality Backlinks

Backlinks are like votes of confidence for your site—and when it comes to link building, quality beats quantity every time.

🔗 Earn quality backlinks by:

- Partnering with local blogs or industry publications

- Publishing guest posts for finance blogs, industry publications, or local business sites.

- Getting mentioned on reputable insurance or finance websites

✅ Track, Analyze, & Improve

SEO is an evolving field where it is crucial to stay informed about Google’s algorithm updates and best practices, especially in the insurance industry.

To identify your areas of improvement:

- Monitor rankings, traffic, and conversions using Google Analytics and Google Search Console

- Adjust strategies based on your SEO performance

- A/B test content and calls-to-action to find what works for your business

Implementing these strategies consistently will help you climb the search rankings, attract qualified leads, and grow your insurance business online. 📈

TL;DR: Ready to Elevate Your Insurance Business?

In short, insurance SEO isn’t just a nice-to-have—it’s your growth engine. By tackling common challenges and applying the right strategies, you can boost your online visibility, earn trust, and turn searches into steady leads.

Don’t let your competitors take the top spot—optimize now, rank higher, and get found by the people who need you most.

🔍 Want More Leads? Start with a Free SEO Audit for Your Insurance Website!

FAQs

Q1. How does Insurance broker SEO help me attract high-intent insurance clients?

A1. SEO, when done right, targets specific keywords your ideal customers are searching for—like “affordable life insurance in [city]”—so you get leads who are ready to buy, not just browsing.

Q2. Do I need separate SEO strategies for different types of insurance I offer?

A2. Yes. Auto, health, life, and home insurance all have different search behaviors—each needs tailored content and keyword strategies to rank effectively.

Q3. Should I build separate landing pages for each insurance product I offer?

A3. Yes. Dedicated pages for auto, life, health, etc., let you target specific keywords, improve relevancy, and boost conversions.

Q4. Is blogging still useful for Insurance SEO in 2025?

A4. Definitely—especially when you create content around customer questions, claim processes, coverage comparisons, or local insurance tips. It’s a lead magnet when done right.

Q5. Will Insurance agent SEO still work if I already run Google Ads for my insurance agency?

A5. Yes, in fact, SEO and paid ads complement each other. While ads offer instant traffic, SEO builds long-term visibility and credibility without ongoing ad spend.

Q6. Can an outdated website design hurt my Insurance SEO performance?

A6. Yes. A slow, cluttered, or non-mobile-friendly site increases bounce rates and hurts rankings. Clean UX, fast load speeds, and mobile optimization are critical ranking factors.

Q7. Do FAQs on my insurance website improve SEO?

A7. Absolutely. FAQs target voice search, long-tail keywords, and featured snippets—great for increasing visibility and providing instant value.

Q8. Is schema markup important for my insurance website?

A8. Yes. Schema helps search engines understand your content better. Use it for reviews, services, locations, and FAQs to enhance your listings with rich results.